salt tax deduction new york

Under the Trump administration Washington launched an all-out direct attack on New Yorks economic future. Web The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

New York Democrats Push Repeal Of Cap On Local Tax Deductions Wsj

Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction. Web Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax. Web New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

Cuomo has been pounding SALT the federal income-tax deduction for state and local taxes. The Budget Act includes a provision that allows partnerships and NYS S. Web For the better part of three years now Gov.

Web New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. Web Cuomo repeatedly has claimed that the SALT cap is costing New Yorkers up to 15 billion a year in higher federal taxes. Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the.

Web The tax law made sweeping changes to the US tax code including limiting the annual deduction amount for state and local taxes SALT to 10000. Why should someone in Pennsylvania earning 100000 pay more federal. Web Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high.

The Pass-Through Entity tax allows an eligible. Web The Debate Over a Tax Deduction. Tom Suozzis letter Fighting the SALT Cap on Behalf of New York Aug.

Web Leaders of the finance industry and other businesses in New York are pushing President Joe Biden and Senate Majority Leader Chuck Schumer to bring back. Web Regarding Rep. Web This election can alleviate the loss of the SALT deduction suffered by many New York taxpayers as a result of the federal SALT cap whether they are New York residents or non.

Web The US. Web Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the. Web Published January 4 2022 at 506 PM EST.

Web Tax Fairness for All Americans. Web The cap disproportionately affected those not subject to the alternative minimum tax AMT which denies certain tax breaks including the SALT deduction to. This number apparently is an estimate of the.

The federal Tax Cuts and Jobs Act of. Web In 2017 a 10000 ceiling on the previously unlimited SALT deduction was enacted and made applicable for tax years beginning in 2018 and continuing through 2025. Web 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments.

Web Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and.

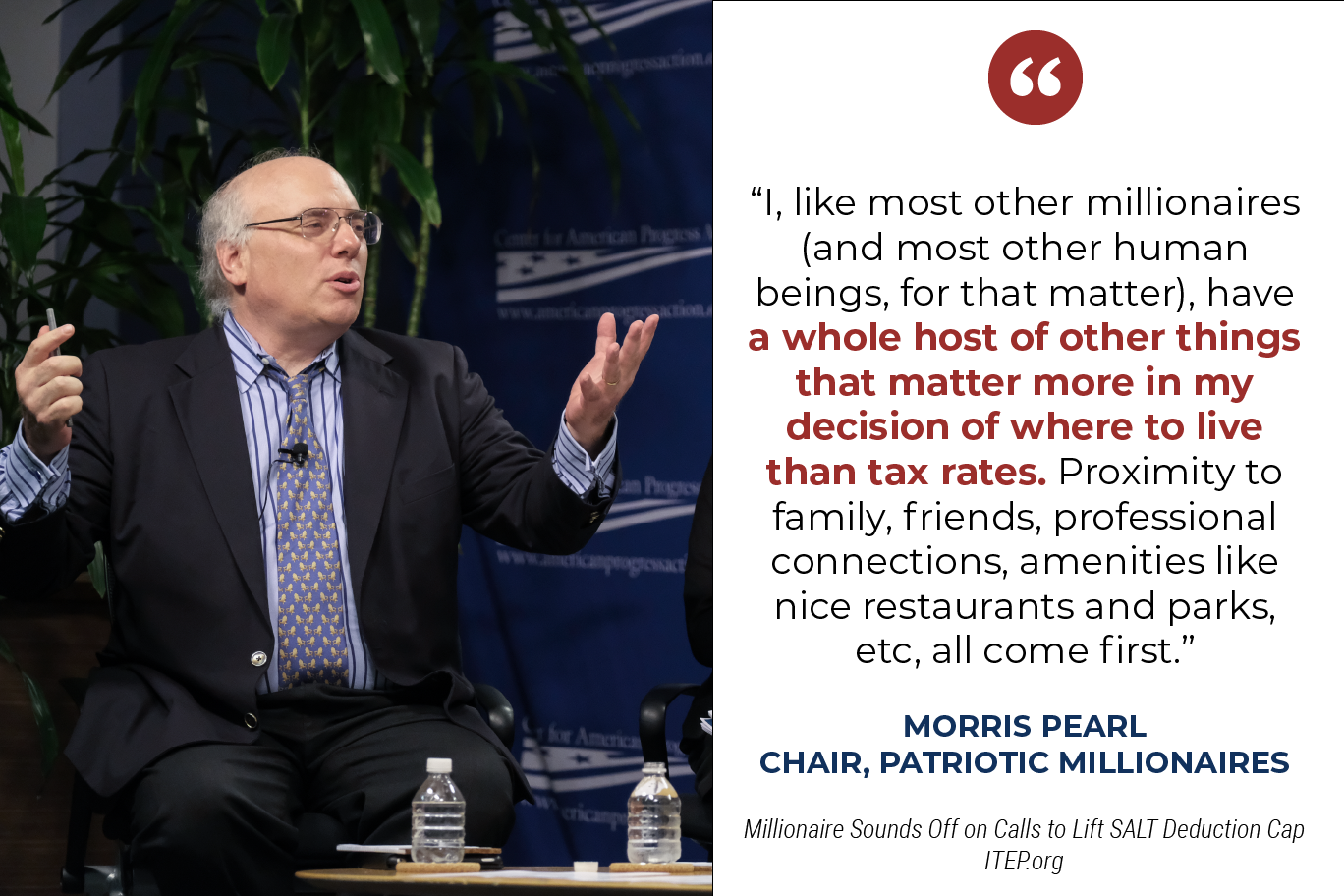

Salt Deduction Cap Should Be Reformed Not Repealed Itep

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

House Democrats Push For Salt Relief In Appropriations Bill

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Prospect Of Salt Deduction Increase Gone At Least For A Few Years Route Fifty

What Is The Salt Deduction H R Block

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Salt Deduction Reinstatement Can Go A Long Way For Nj Ny Families

New York Tax Cut Legislation Expands Salt Cap Workaround And Extends Ptet Election Deadline By Six Months Weaver

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

How Does The Deduction For State And Local Taxes Work Tax Policy Center

New York Congressman Pushes To Restore Salt Tax Deductions Wsj

Changes To The State And Local Tax Salt Deduction Explained

Scotus Swats Away Salt Cap Challenge That Limits Tax Deductions In New York Maryland Fox News

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities