what is a good expense ratio for an insurance company

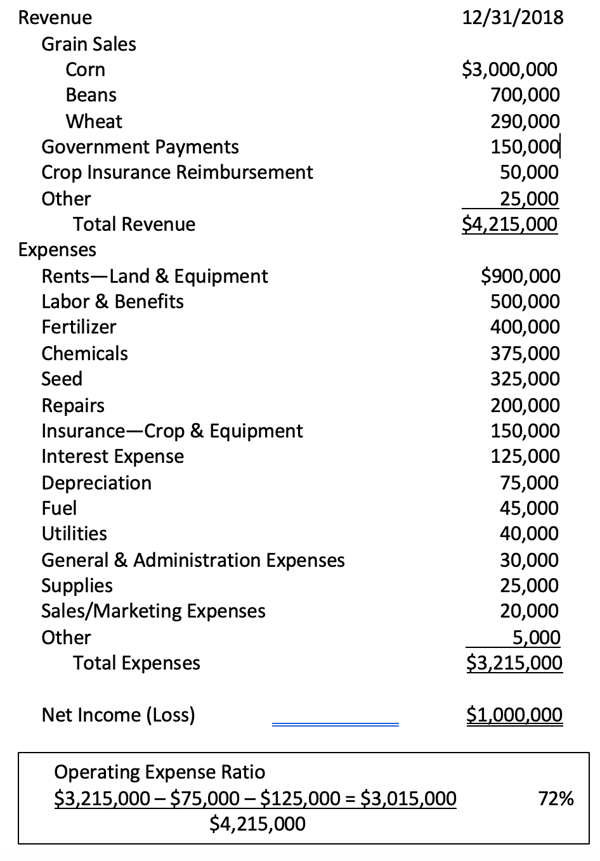

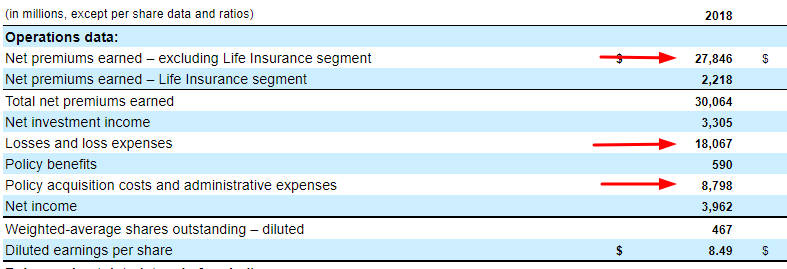

It is worth noting that expense ratios are a fundamental part of. The statutory method where insurance companies divide their expenses by the premiums they have earned.

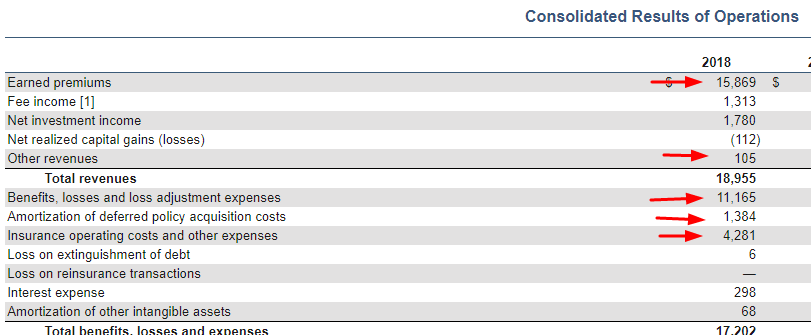

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

In future there are good chances that insurance company keeps honoring the claims in the same way that is indicated in the health insurance policy document.

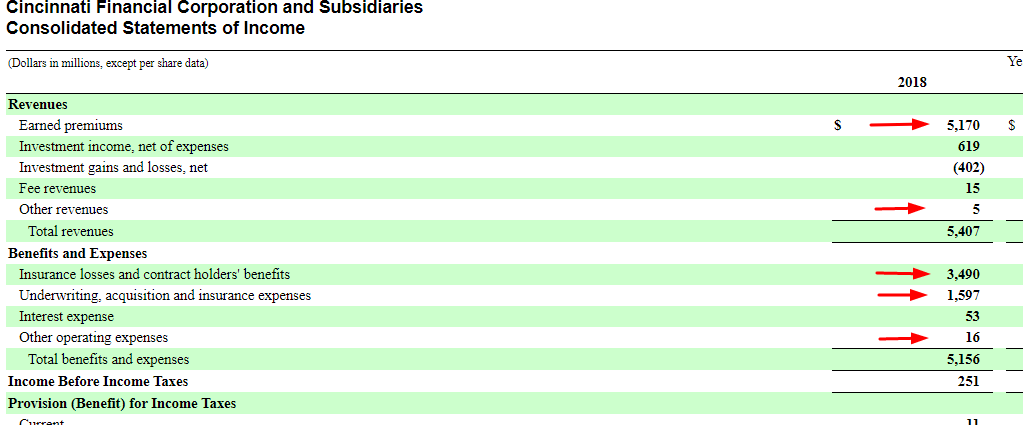

. The Expense Ratio serves as the ideal measure providing clarity on the logistics. PC Insurance Underwriting Expense Ratio measures total company operating expenses not including claims losses or loss adjustment expense relative to total PC premium earned. What is an Acceptable Loss Ratio.

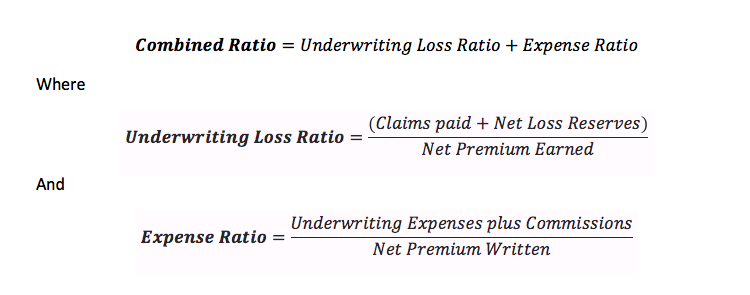

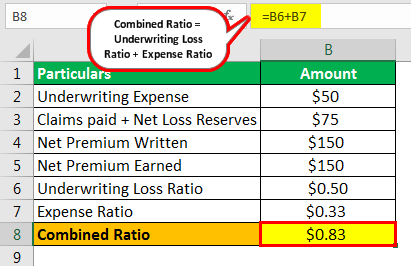

Expense ratio is the ratio of underwriting expenses to earned. Signifying the efficiency of an insurance company and measuring its profitability the expense. An expense ratio is the cost of owning a mutual fund or exchange-traded fund ETF.

If you are a qualified. USBR calculates the loss ratio by dividing loss adjustments expenses by premiums earnedThe loss ratio shows what percentage of payouts are being settled with recipients. What is a good expense to income ratio.

Expense ratio reflects the efficiency of insurance operations. Expense Ratio the percentage of premium used to pay all the costs of acquiring writing and servicing insurance and reinsurance. Each insurance company formulates its own.

This ratio provides insight into the quality of the policies an insurance company writes and the rates it charges. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. This indicates that the business is.

Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. JAC By Jac Allen. Are musicians able to deduct business expenses 2018.

When car insurance companies price policies your vehicles make and model can influence rates significantly. Expense ratio for an insurer would be analysed by class of business along with the trend of the same Combined ratio Loss Ratio. Think of the expense ratio as the management fee paid to the fund company for the.

High expense ratios can drastically reduce your potential. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds ETFs.

The loss ratio should be used in conjunction with the expense ratio to determine the companys profitability. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. The remaining 40 of your premium dollar is spent on expenses such as claims handling insurance company filing fees taxes overhead agent commissions and attorney.

There are two methodologies to measure the expense. Therefore the lower a companys cost-to-income ratio the better theyre performing.

Combined Ratio In Insurance Definition Formula Calculation

Combined Ratio Formula Calculation Example Analysis Definition

Combined Ratio Benefits And Limitations Of Combined Ratio

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

/latex_9e2c1ac6ab137d491840c617b8949346-5c5069e2c9e77c0001d7bce5.jpg)

Total Expense Ratio Ter Definition

Combined Ratio In Insurance Definition Formula Calculation

How The Combined Ratio Reveals Profitable Insurance Companies To Investors